EMAC Reimbursement

The Basis of

Reimbursement

Learn More

The Basis of EMAC Reimbursement

In summary, it says that any expense, except workers' compensation, incurred while performing an EMAC mission is reimbursable provided that the expense is reasonable, mission-related, incurred during the conduct of the mission, and documented.

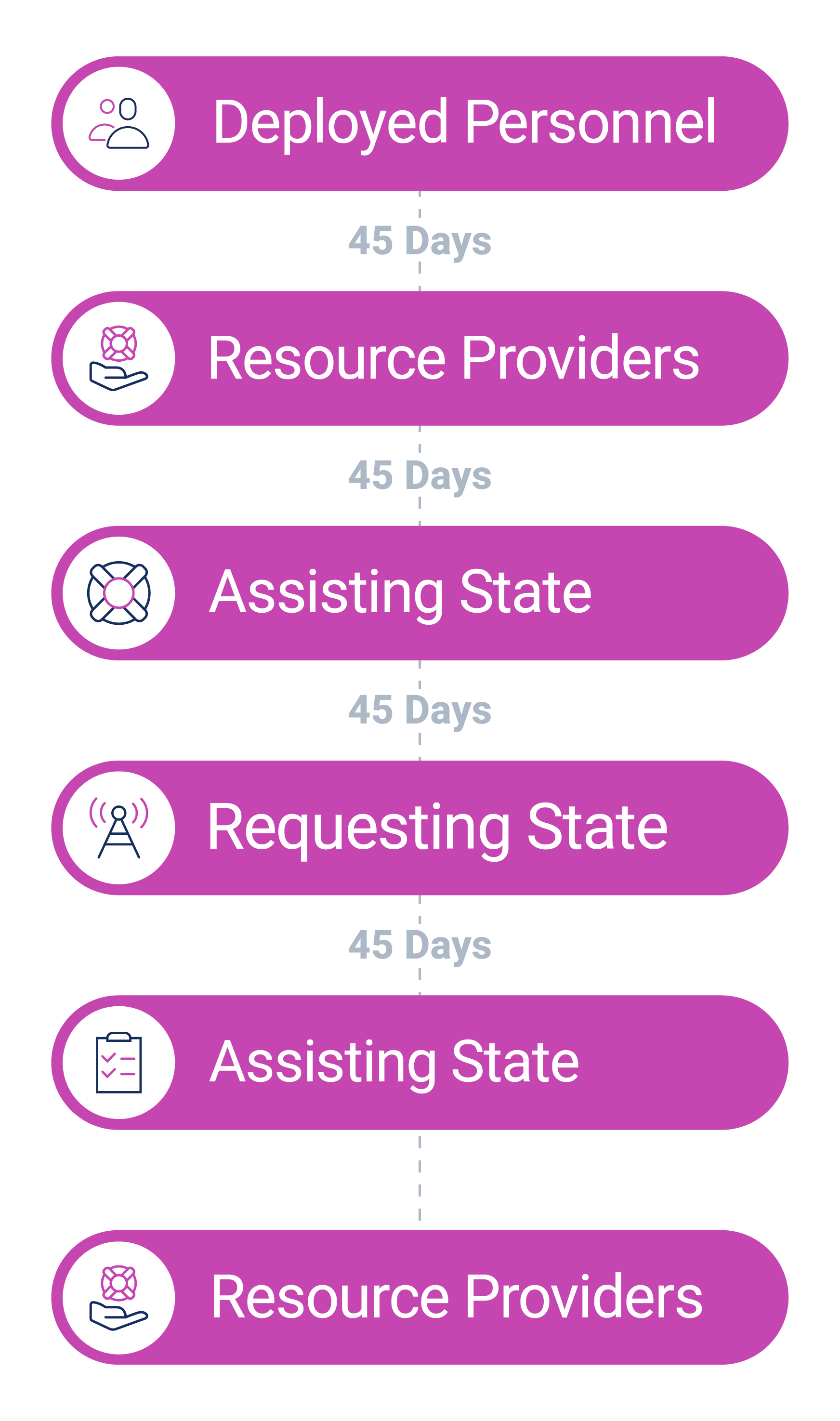

Reimbursement Responsibilities Throughout the EMAC Process

Reimbursement is part of every phase of the EMAC Process:

Pre-Event Preparation, Activation, Request & Offer, Response, and Reimbursement.

Learn more using the graphic, below.

- Take EMAC training. You can start by taking the EMAC: Just In Time Training for Deploying Personnel which will give you a good basis for understanding EMAC and the reimbursement process

- Review your agency (Resource Provider) EMAC reimbursement guidelines to ensure you understand cost eligibility, record-keeping requirements, and processes

- Develop a record-keeping system and identify who will be responsible for tracking costs while on an EMAC mission

- Work with your agency (Resource Provider) to develop a Mission Ready Package

- Download and review the EMAC Standard Operating Guidelines for Resource Providers and Deploying Personnel

Resource Providers:

- Take EMAC training. Two courses are recommended: EMAC: Just in Time Training and Pre-Event Preparation

- Develop internal EMAC reimbursement guidelines to standardize the reimbursement process, the timelines, and clarify cost eligibility

- Identify who will be responsible for developing the reimbursement package and adhering to timelines

- Develop Mission Ready Package with eligible costs and upload them to the Mutual Aid Support System

- Download and review the EMAC Standard Operating Guidelines for Resource Providers and Deploying Personnel

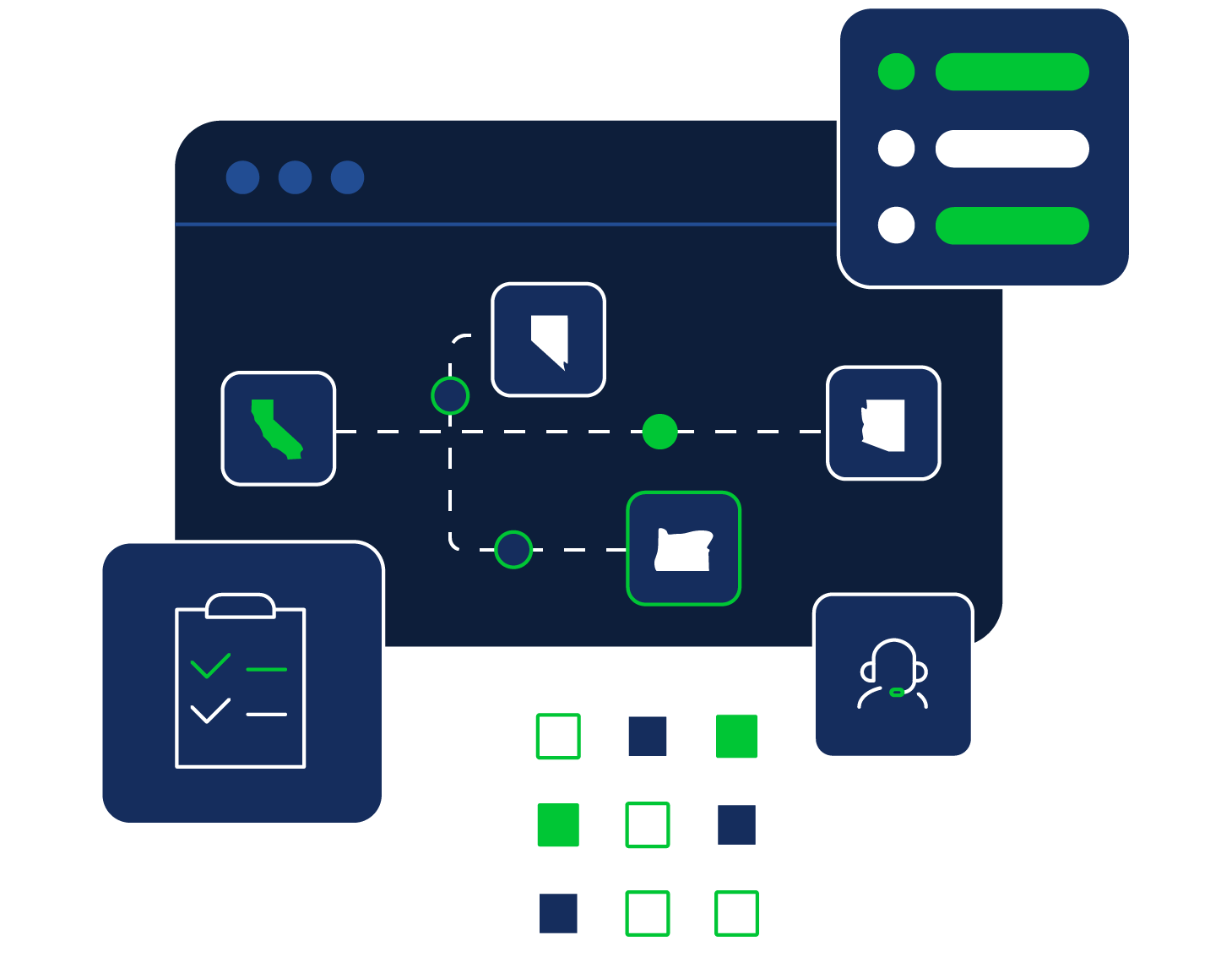

Assisting States:

- Train Resource Providers and potential Deploying Personnel on the state EMAC program

- Develop internal EMAC reimbursement guidelines to standardize the reimbursement process and clarify cost eligibility

- Develop internal procedures that specify how reimbursement claims will be processed, including the names and positions of those who will oversee the process

- Training finance administration on both EMAC and internal guidelines and procedures

- Develop and maintain response-specific Mission Ready Packages to ensure identified costs are eligible

Requesting States:

- Train everyone with reimbursement responsibilities on EMAC reimbursement guidelines and state reimbursement guidelines

- Develop internal EMAC reimbursement guidelines to standardize the reimbursement process and clarify cost eligibility

- Develop internal procedures that specify how reimbursement claims will be processed including the names and positions of those who will oversee the process

- Identify funding sources to pay EMAC missions

- Identify finance/administration personnel who will be responsible for reimbursement

- Review EMAC reimbursement procedures

- Identify any documentation requirements above and beyond what is in the EMAC Operations Manual and clearly identify it in the reqeust for assistance

Assisting States:

- Work with Resource Providers to update or develop Mission Ready Packages (MRPs) to submit offers of assistance. Ensure MRPs contain only eligible costs

- Review reimbursement procedures with Resoruce Providers

- Review cost eligiblity and source documentation requirements

- Review any additional documentation requirements as identified by the Requesting State in the request

- Make offers of assistance to the Requestings State to identify the estimated eligible costs

Resource Providers:

- Work with the Assisting State to update or develop your Mission Ready Package (MRP) so it can be used as the basis of the offer of assistance

- Identify any differences between the EMAC Mission Order Authorization Form (the mission order given to the deploying team) and reality

- Report any differences to your home state (Assisting State) emergency management agency

- Track costs

- Maintain receipts

- Report any damage to equipment immediately to your home state (Assisting State)

Requesting and Assisting States:

- Complete amendments to the EMAC Resource Support Agreement (RSA), as needed

- Within 45 days of returning hom from your EMAC mission, submit all documentation and records to your home agency (Resource Provider)

Resource Providers:

- Reimbursing Deployed Personnel for travel expenses, updating time keeping systems to reflect mission work hours, and paying other eligible expenses incurred in connection with the EMAC mission

- Collect and compile source documemtation from Deployed Personnel

- Complete accounting entries for payroll and travel costs

- Develop a separate EMAC Reimbursement Package for each EMAC Mission to include the following:

- A summary of all expenses incurred and paid by the Resource Provider on the EMAC R-2 Intrastate Reimbursement Form. Be sure to sign the form upon completion. Download a copy of the EMAC R-2 Job Aid and the Fringe Benefits Explained Job Aid.

- A signed cover letter, on the Resource Provider’s letterhead which includes, at a minimum, the following:

- Amount of the reimbursement claim

- Amount(s) of any donated resources

- Remittance address

- Any special instructions for the Assisting State that may assist with review of the reimbursement package

- Completed IRS Form W-9

- Copies of all source documentation, as outlined under “Cost Eligibility”

- Policy documents to support claims (salary, overtime, per diem rates, etc.)

Assisting States:

- Audit the reimbursement package from the Resource Provider, reconcile any issues

- Develop the Assisting State reimbursement package per the EMAC Operations Manual Guidelines

- Submit the reimbursement package to the Requesting State within 45 days of receiving reimbursement package from Resource Providers

Requesting States:

- Audit the reimbursement package from the Assisting State and reconcile any issues

- Issue payment to the Assisting State with 45 days of receipt of the reimbursement package

Notes:

- A state’s obligation to pay EMAC reimbursements is not contingent upon the receipt of federal funds

- The EMAC RSA, the legally binding agreement completed for every EMAC mission, is based upon estimated costs. Reimbursement costs should mirror; but will not exactly match the RSA

- A state may donate services, in part or in whole

- Take EMAC training. You can start by taking the EMAC: Just In Time Training for Deploying Personnel which will give you a good basis for understanding EMAC and the reimbursement process

- Review your agency (Resource Provider) EMAC reimbursement guidelines to ensure you understand cost eligibiliy, record keeping requirements, and processes

- Develop a record keeping system and identify who will be responsible for tracking costs while on an EMAC mission

- Work with your agency (Resource Provider) to develop a Mission Ready Package

- Download and review the EMAC Standard Operating Guidelines for Resource Providers and Deploying Personnel

Resource Providers:

- Take EMAC training. Two courses are recommended: EMAC: Just in Time Training and Pre-Event Preparation

- Develop internal EMAC reimbursement guidelines to standardize the reimbursement process, timelines, and clarify cost eligibility

- Identify who will be reponsible for developing the reimbursement package and adhering to timelines

- Develop Mission Ready Package with eligible costs and upload them in the Mutual Aid Support System

- Download and review the EMAC Standard Operating Guidelines for Resource Providers and Deploying Personnel

Assisting States:

- Train Resource Providers and potential Deploying Personnel on the state EMAC program

- Develop internal EMAC reimbursement guidelines to standardize the reimbursement process and clarify cost eligibility

- Develop internal procedures that specify how reimbursement claims will be processed, including the names and positions of those who will oversee the process

- Training finance administration on both EMAC and internal guidelines and procedures

- Develop and maintain response specific Mission Ready Packages to ensure identified costs are eligible

Requesting States:

- Train everyone with reimbursement responsibilities on EMAC reimbursement guidelines and state reimburesment guidelines

- Develop internal EMAC reimbursement guidelines to standardize the reimbursement process and clarify cost eligibility

- Develop internal procedures that specify how reimbursement claims will be processed including the names and positions of those who will oversee the process

- Identify funding sources to pay EMAC missions

- Identify finance/administration personnel who will be responsible for reimbursement

- Review EMAC reimbursement procedures

- Identify any documentation requirements above and beyond what is in the EMAC Operations Manual and clearly identify it in the reqeust for assistance

Assisting States:

- Work with Resource Providers to update or develop Mission Ready Packages (MRPs) to submit offers of assistance. Ensure MRPs contain only eligible costs

- Review reimbursement procedures with Resoruce Providers

- Review cost eligiblity and source documentation requirements

- Review any additional documentation requirements as identified by the Requesting State in the request

- Make offers of assistance to the Requestings State to identify the estimated eligible costs

Resource Providers:

- Work with the Assisting State to update or develop your Mission Ready Package (MRP) so it can be used as the basis of the offer of assistance

- Identify any differences between the EMAC Mission Order Authorization Form (the mission order given to the deploying team) and reality

- Report any differences to your home state (Assisting State) emergency management agency

- Track costs

- Maintain receipts

- Report any damage to equipment immediately to your home state (Assisting State)

- Complete amendments to the EMAC Resource Support Agreement (RSA), as needed

- Within 45 days of returning hom from your EMAC mission, submit all documentation and records to your home agency (Resource Provider)

Resource Providers:

- Reimbursing Deployed Personnel for travel expenses, updating time keeping systems to reflect mission work hours, and paying other eligible expenses incurred in connection with the EMAC mission

- Collect and compile source documemtation from Deployed Personnel

- Complete accounting entries for payroll and travel costs

- Develop a separate EMAC Reimbursement Package for each EMAC Mission to include the following:

- A summary of all expenses incurred and paid by the Resource Provider on the EMAC R-2 Intrastate Reimbursement Form. Be sure to sign the form upon completion. Download a copy of the EMAC R-2 Job Aid and the Fringe Benefits Explained Job Aid.

- A signed cover letter, on the Resource Provider’s letterhead which includes, at a minimum, the following:

- Amount of the reimbursement claim

- Amount(s) of any donated resources

- Remittance address

- Any special instructions for the Assisting State that may assist with review of the reimbursement package

- Completed IRS Form W-9

- Copies of all source documentation, as outlined under “Cost Eligibility”

- Policy documents to support claims (salary, overtime, per diem rates, etc.)

Assisting States:

- Audit the reimbursement package from the Resource Provider, reconcile any issues

- Develop the Assisting State reimbursement package per the EMAC Operations Manual Guidelines

- Submit the reimbursement package to the Requesting State within 45 days of receiving reimbursement package from Resource Providers

Requesting States:

- Audit the reimbursement package from the Assisting State and reconcile any issues

- Issue payment to the Assisting State with 45 days of receipt of the reimbursement package

Notes:

- A state’s obligation to pay EMAC reimbursements is not contingent upon the receipt of federal funds

- The EMAC RSA, the legally binding agreement completed for every EMAC mission, is based upon estimated costs. Reimbursement costs should mirror; but will not exactly match the RSA

- A state may donate services, in part or in whole

- Take EMAC training. You can start by taking the EMAC: Just In Time Training for Deploying Personnel which will give you a good basis for understanding EMAC and the reimbursement process

- Review your agency (Resource Provider) EMAC reimbursement guidelines to ensure you understand cost eligibiliy, record keeping requirements, and processes

- Develop a record keeping system and identify who will be responsible for tracking costs while on an EMAC mission

- Work with your agency (Resource Provider) to develop a Mission Ready Package

- Download and review the EMAC Standard Operating Guidelines for Resource Providers and Deploying Personnel

Resource Providers:

- Take EMAC training. Two courses are recommended: EMAC: Just in Time Training and Pre-Event Preparation

- Develop internal EMAC reimbursement guidelines to standardize the reimbursement process, timelines, and clarify cost eligibility

- Identify who will be reponsible for developing the reimbursement package and adhering to timelines

- Develop Mission Ready Package with eligible costs and upload them in the Mutual Aid Support System

- Download and review the EMAC Standard Operating Guidelines for Resource Providers and Deploying Personnel

Assisting States:

- Train Resource Providers and potential Deploying Personnel on the state EMAC program

- Develop internal EMAC reimbursement guidelines to standardize the reimbursement process and clarify cost eligibility

- Develop internal procedures that specify how reimbursement claims will be processed, including the names and positions of those who will oversee the process

- Training finance administration on both EMAC and internal guidelines and procedures

- Develop and maintain response specific Mission Ready Packages to ensure identified costs are eligible

Requesting States:

- Train everyone with reimbursement responsibilities on EMAC reimbursement guidelines and state reimburesment guidelines

- Develop internal EMAC reimbursement guidelines to standardize the reimbursement process and clarify cost eligibility

- Develop internal procedures that specify how reimbursement claims will be processed including the names and positions of those who will oversee the process

Eligible Expenses & Source Documentation Requirements

Eligible ExpensesEligible costs include expenses that are typically incurred when conducting or traveling on an EMAC mission. Expenses should align to the EMAC Resource Support Agreement (RSA). Eligible categories for cost reimbursement are as follows: Personnel, Travel (such as air and ground transportation). Lodging, Meals, Equipment, Commodities and Other. |

|---|

PersonnelLearn what personnel costs are eligible and how expenses should be documented. Personnel Eligible Costs:

Eligibility of overtime, holiday, and compensatory time is based on the Resource Provider’s pre-event written labor policy. States may consider modifications to policies to make clear labor policy that apply to EMAC deployments. Personnel Documentation:

Note: Reports from financial systems generally show the recorded expenses for both salaries/wages and fringe benefit contributions. If a Resource Provider does not have a financial reporting system, they may submit pay stubs. Personnel Ineligible Costs:

Personnel Negotiated Costs: Negotiated costs are costs that are only eligible if included in the RSA, agreed upon by both the Requesting and Assisting States, and allowable by state law and policies. If the Assisting State has a policy that disallows negotiated costs, that policy must be followed. This includes the following:

Note: Pre-deployment, post-deployment, training, and exercise costs are not eligible for reimbursement under the FEMA Public Assistance (PA) Program. |

|---|

Air TravelLearn about eligible air travel expenses and how they should be documented. Airfare Eligible Costs:

Note: Extenuating circumstances may create a situation where a reasonable rate (economy/coach) cannot be secured for the Deploying Personnel airfare (e.g., only premium seats exist on available flights). In these instances, the Assisting State should communicate the situation to the Requesting State and see if, 1) the start date of the mission can be adjusted back, or 2) the higher priced tickets should be purchased due to the urgent need of the resources. Either situation should be documented appropriately for reimbursement purposes. Airfare Ineligible Costs:

Airfare Documentation:

|

|---|

MealsLearn what meal costs are eligible (receipt method and per diem) and how expenses should be documented. Per Diem MealsMeals Per Diem Method Meal per diem rates for each mission day (breakfast, lunch, dinner, and incidentals) at the rate established by the Resource Provider’s travel policy. If no policy exists, the Resource Provider should follow the Assisting State’s policy or use the federal per diem rates (CONUS: www.gsa.gov or OCONUS: defensetravel.dod.mil). Ineligible Expenses:

Meals Per Diem Method

Receipt MealsMeals Receipt Method Eligible Costs: The actual costs of any meals purchased throughout the course of a mission (e.g., breakfast, lunch, and dinner). The basis of reimbursement is dependent on the Resource Provider’s travel policy. If no policy exists, the Resource Provider should follow the Assisting State’s policy or use the federal per diem rates (CONUS: www.gsa.gov or OCONUS: defensetravel.dod.mil). When claiming actual costs, Resource Providers shall ensure the meal costs are reasonable prior to submitting for reimbursement. It is recommended the actual cost of meals be in line with established federal per diem rates for the area. Any costs that significantly exceed the federal per diem rate may be denied by the Requesting State. In this instance, the Requesting State would only reimburse an amount equal to the federal per diem rate. Ineligible Costs:

Meals Receipt Method Documentation:

|

|---|

LodgingLearn about eligible lodging expenses and how they should be documented. Lodging Eligible Expenses: The costs associated with any lodging arrangements needed throughout the course of the mission (e.g., hotels, Airbnb, VRBO, campgrounds, etc.). Resource Providers shall make every effort to secure the lowest rate available or government rate (www.gsa.gov). Notes:

Lodging Ineligible Expenses: Costs for lodging when accommodations are made available or paid by the Requesting State. Lodging Documentation:

|

|---|

Ground TransportationLearn about eligible ground transportation expenses and how they should be documented. Ground Transportation Eligible Expenses: The costs of ground transportation (e.g., taxis, shuttles, ride share). Rental vehicle and fuel. Mileage rates for privately owned vehicle (POV), and government owned vehicle (GOV) to/from the airport, collective departure point, travel to/from mission location, or daily work location(s) during their deployment. Note: For POVs and GOVs, the cost of fuel or mileage are both acceptable as a basis of reimbursement. The decision to request fuel or mileage is dependent on what the Resource Provider’s organizational policy prescribes as allowable. If no policy exists, the Resource Providers can adopt the Assisting State’s mileage rate or use a federal mileage rate, specifically FEMAs Schedule of Equipment Rates. For any rate established by the Resource Provider, the rate should incorporate all the following cost components; operating costs, overhead, depreciation, repairs and maintenance, and vehicle fluid (oil, fuel, etc.) consumption. Jurisdictional rates are still subject to reasonable costs as detailed further below. Ground Transportation Ineligible Expenses:

Ground Transportation Documentation:

Fuel: Receipts, if claiming fuel (credit card statements is not acceptable documentation). Mileage:

|

|---|

Parking and Toll CostsLearn about expenses for parking and tolls and how they should be documented. Parking & Tolls Eligible Expenses: Parking fees and highway/bridge tolls are eligible for reimbursement. Parking & Tolls Ineligible Expenses:

Parking & Tolls Documentation:

|

|---|

EquipmentLearn what equipment expenses are eligible for reimbursement and how they should be documented. Equipment by Rate Eligible Expenses: The actual cost of fuel and maintenance incurred during the mission or the cost of using the equipment based on an equipment usage rate, are eligible. Equipment rates can be those established under the Resource Provider’s own guidelines, Assisting State guidelines, or FEMAs Schedule of Equipment Rates. See section on the reasonableness of rates when using jurisdictional policies. For any rate established by the Resource Provider, the rate should incorporate all of the following cost components; cost of ownership and operation of the equipment including depreciation, overhead, all maintenance, field repairs, fuel, lubricants, tires, and other costs incidental to operation. Jurisdictional rates are still subject to reasonable costs detailed further below. Equipment by Rate Ineligible Expenses:

Equipment by Rate Negotiated Costs: Negotiated costs are costs that are only eligible if included in the RSA and agreed upon by both the Requesting and Assisting states and allowable by state law and policies. Note that negotiated cost may not be eligible under federal funding but if agreed upon in the RSA must be reimbursed. This includes the following:

Documentation Requirements

Equipment Repair or Replacement Reasonable costs to repair or restore damaged equipment to its pre-deployment condition or replace destroyed equipment. Note: It is incumbent upon the Resource Provider to demonstrate the damage occurred within the mission dates and the damage is mission related (through reporting of the damages to the state EMA, images, affidavits, email, etc.). Damages that are not reported within a reasonable timeframe may not be allowed. Documentation:

It is recommended that the RSA is amended to include damaged or destroyed equipment. Ineligible Costs:

|

|---|

CommoditiesLearn what commodity expenses are eligible for reimbursement and how they should be documented. Commodities Eligible Expenses: Consumables and other supplies and materials that are necessary to perform the mission. Examples of commodities includes, but is not limited to, the following:

Commodities Ineligible Expenses:

Commodities Documentation:

|

|---|

OtherLearn what "Other" expenses are eligible for reimbursement and how they should be documented. Other Expenses by Rate Eligible Expenses: Non-equipment costs such as service charges that are billed by rate. Examples of other by rate includes, but is not limited to, the following:

Documentation:

Ineligible Costs:

Other Expenses by Quantity Eligible Expenses: Non-equipment costs that are billed by receipt or invoice. Examples of other by quantity includes, but is not limited to, the following:

Documentation:

Ineligible Costs:

Documentation Requirements Zero balance receipt that establishes the rate / quantity |

|---|

Ineligible CostsLearn what costs are not eligible for reimbursement Additional Examples of Ineligible Costs

|

|---|

Negotiated CostsLearn what costs may be negotiated between states Negotiated Costs As noted within each cost category, some costs are eligible if agreed upon by both the Requesting and Assisting States at the time of the Request and Offer and completion of the RSA. Negotiated costs must be in the RSA to be eligible and must be allowable through state laws and procedures. Negotiated costs shall be clearly defined, stated and identifiable in the offer of assistance and RSA as negotiated costs. For example, if backfill costs are in the offer, they must be labeled as “Backfill” under the appropriate cost category. Any agreed upon negotiated costs that is found to be prohibited by a pre-existing state policy will be disallowed. The pre-existing policy must be in place at the time of the execution of the RSA. If “negotiated costs” are not in the RSA, they will be immediately denied for reimbursement. |

|---|

Download the EMAC

Eligible Expenses Guide

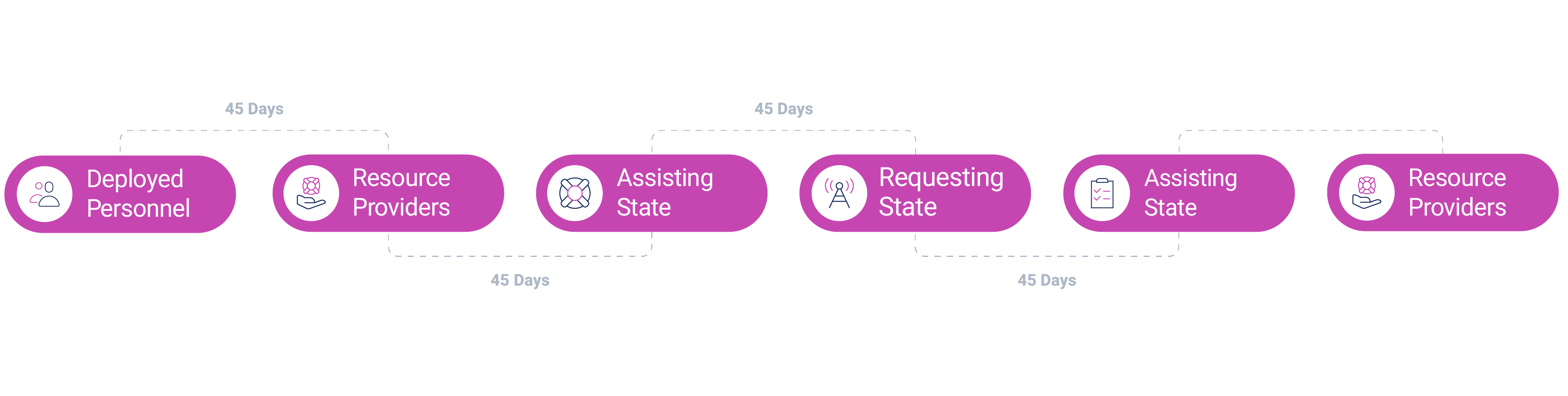

DownloadSuggested Reimbursement Timelines

While delays in the reimbursement process can happen, all parties to the reimbursement process should strive to accomplish their responsibilities within the suggested reimbursement timelines.

It is also critically important to communicate delays to all parties as soon as they are identified.

Reimbursement Resources

Deploying personnel should remember to establish a "paperwork system" and become knowledgable of reimbursement policy and procedures prior to their deployment.

During the deployment, maintain documentation and alert the home state emergency management agency to any changes in the mission that may impact the costs.

Upon returning home, organize and submit travel vouchers and documentation to your home agency (Resource Provider) and be prepared to assist in perparing the reimbursement package to send to the home state emergency management agency.

Reimbursement starts before the mission begins and doesn't end until everyone - Deployed Personnel, Resource Providers, and Assisting States have been reimbursed. The speed at which the reimbursement process moves is also dependent upon everyone within the process. Make sure you understand you understand your responsibilities. Together we can make reimbursement an efficient process.

Pre-Event Preparation

Pre-Event Preparation  Activation

Activation  Request & Offer

Request & Offer  Response

Response  Reimbursement

Reimbursement